irs child tax credit tool

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The agency also unveiled a non-filer tool last week which allows families who dont normally file taxes to enroll.

New Irs Tool For Families Trying To Get Child Tax Credit Payments

Ad Home of the Free Federal Tax Return.

. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Families receiving child tax credit payments have until tonight to inform the IRS of any significant income changes for those changes to be reflected in the payment coming. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

This year eligible families can use GetCTC to receive the 2021 Child Tax Credit expanded last year to 3600 per child 5 and under and 3000 per child 6 to 17. The payments are part of the American Rescue Plan a 19 trillion package that increased the 2021 child tax credit from 2000 to 3600. An online tool for taxpayers who dont normally file tax returns has been updated to provide the IRS with information to claim the 2021 Child Tax Credit.

Child Tax Credit Eligibility Assistant helps families determine whether they qualify for Child Tax Credit payments Update Portal helps families monitor and manage Child Tax. The bill also allowed families the. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The Child Tax Credit for tax year 2021 is up. WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. This new tool is accessible just on IRSgov.

The IRS urges families to use a special online tool available only on IRSgov to help them determine whether they qualify for the child tax credit and the special monthly advance. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July.

IRS Resources and Guidance Includes e-posters in other languages user. The Child Tax Credit Update Portal is no longer available. See what makes us different.

The IRS has launched an online tool to help low-income families register for monthly child tax credit payments. Families who guarantee the Child Tax Credit for 2021 will get up to 3000 per qualifying child who is somewhere in the range of 6 and 17 years of. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

E-File Directly to the IRS. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021.

The IRS will make a one-time payment of 500 for dependents. The total changes to 3000 per child for parents of six to 17 year olds or 250 per month and 1500 at tax time. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

We dont make judgments or prescribe specific policies. This is up from the existing credit of up to 2000 per child under. Similar to certain other credits with an advance payment option taxpayers who receive.

The payments are part of a 2021 expansion to the existing Child. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. IR-2021-150 July 12 2021.

Ad Home of the Free Federal Tax Return. But it doesnt work on mobile devices which advocacy. The Internal Revenue Service IRS has released two online tools to help families with the new monthly child tax credit payments that are part of the 19 trillion third stimulus.

IR-2021-133 June 24 2021 The Treasury Department and the IRS today urged families to take advantage of a special online tool that can help them determine whether they. Use our simplified tax filing tool to claim your Child Tax Credit Earned Income Tax Credit and any missing amount of your third stimulus payment. E-File Directly to the IRS.

The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18.

Tas Tax Tips Does The Irs Have Your Information On File If Not See If You Should Use The Child Tax Credit Non Filer Sign Up Tool Taxpayer Advocate Service

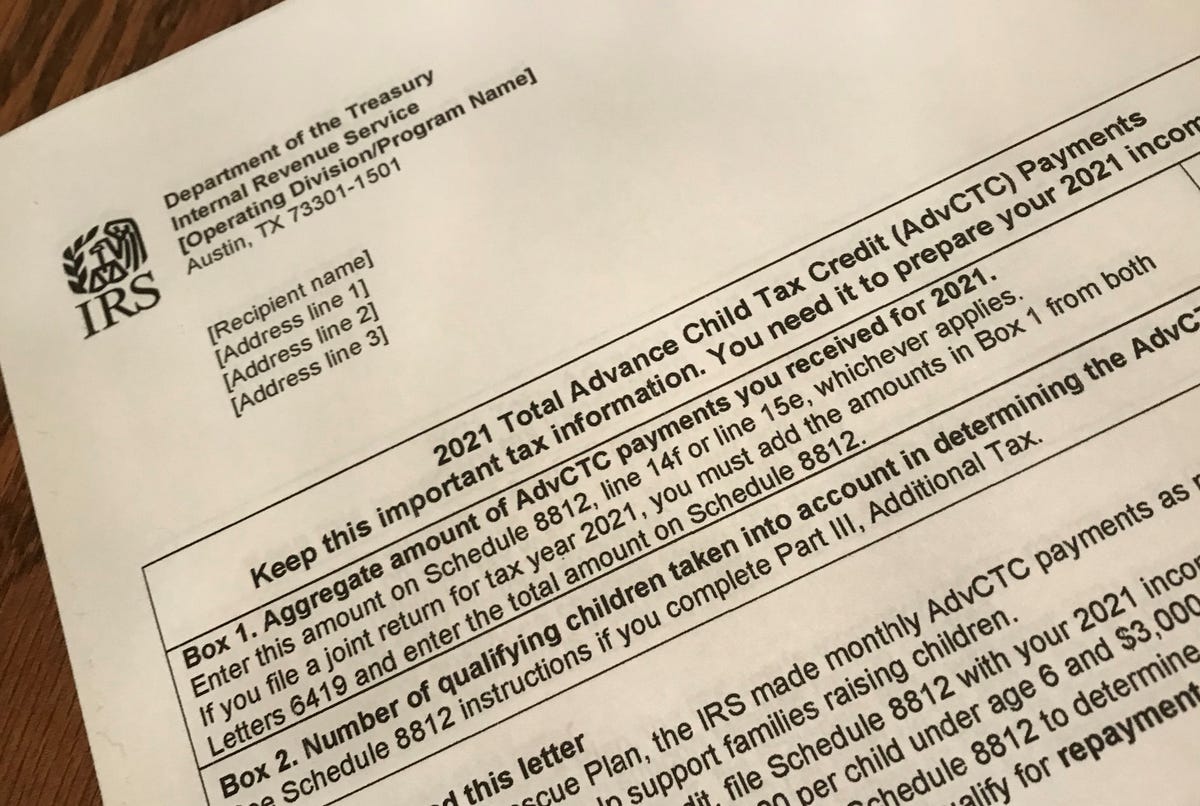

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Tool Reopens For Families Missing Payments Ktla

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Irs Online Tool Helps Families See If They Qualify For The Child Tax Credit

/do0bihdskp9dy.cloudfront.net/06-15-2021/t_965444cdf3804e34affaa4dad4a66df1_name_file_1280x720_2000_v3_1_.jpg)

Irs Launches New Online Tool For Child Tax Credit

Child Tax Credit Irs Creates Nonfiler Sign Up Tool

Irsnews On Twitter Irs Offers The Child Tax Credit Eligibility Assistant In English And Spanish This Interactive Tool Can Help Your Family Determine Whether You Qualify For The Childtaxcredit See Https T Co 535gr8o86p Hhm

Millions Of Families Received Irs Letters About The Child Tax Credit

Expanded Child Tax Credit Senator Bernie Sanders

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Tas Tax Tip Check Out These Advance Child Tax Credit Tools Tas

Irsnews On Twitter An Irs Tool Now Enables Families To Quickly And Easily Unenroll From Receiving Monthly Payments Of The Childtaxcredit If They So Choose Https T Co Qt9tauwjvv Https T Co Zmqoijn0gv Twitter

Child Tax Credit You Can Finally Update Your Income Online Money

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Irs Child Tax Credit Scam You Don T Need To Text Anyone

Irs Tool Offers Low Income Families A Tool To Get Child Tax Credit And Stimulus Checks Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Irs Rolls Out New Web Tools On Expanded Child Tax Credit The Hill